Связанные статьи

Волатильность рынка — это не только возможность заработать, но и риск потерять депозит. Чтобы оставаться в игре, трейдеру нужна гибкость, особенно когда на рынке наблюдаются резкие колебания цен.

Вот тут и помогает режим Cross Margin — он продлевает “жизнь” ваших сделок, объединяя маржу по всем позициям. В итоге ваш депозит подстраивается под движение рынка, а не наоборот.

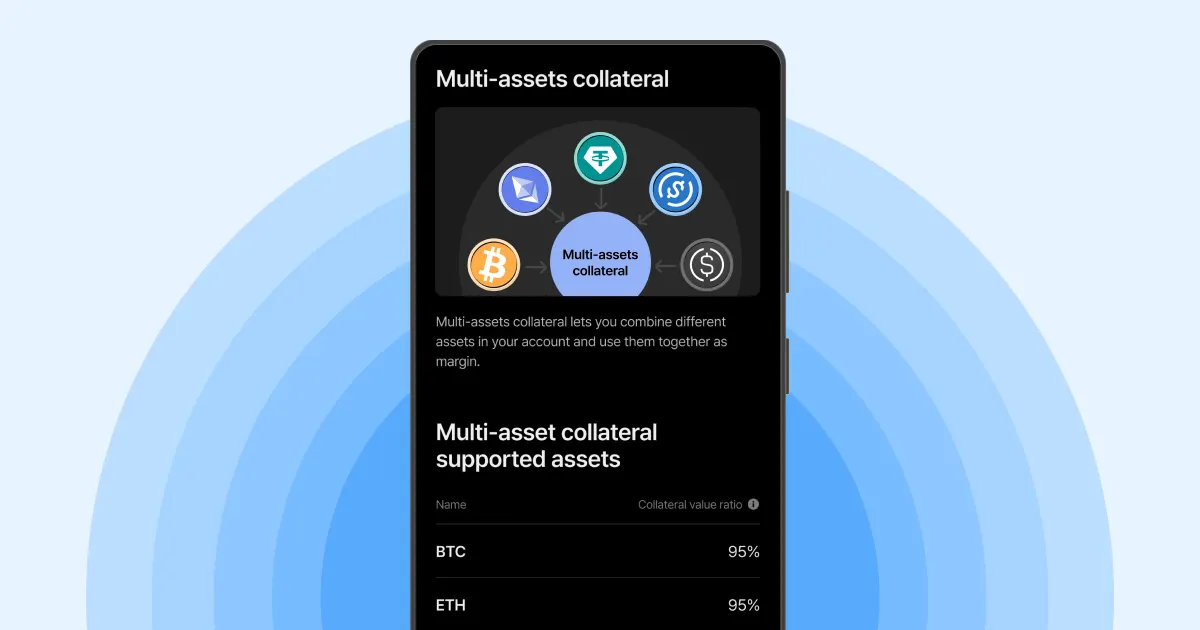

Торгуя на Flipster, вы будете уверены в том, ваши BTC, ETH, USDT, USDC и цифровые доллары вроде USDe не лежат без дела — они активно поддерживают и балансируют ваш портфель.

Когда вы включаете режим Кросс-маржи, Flipster автоматически объединяет все подходящие активы (BTC, ETH, USDT, USDC, USDe) в единую маржу.

Дальше система динамически регулирует баланс в зависимости от состояния позиций:

Нереализованная прибыль может покрывать временные убытки.

Порог ликвидации меняется в реальном времени.

Активы, задействованные в марже, продолжают участвовать в бонусных и промо-акциях

Flipster

.

Каждая позиция получает выгоду от общей ликвидности, так как риск ликвидации при резких движениях рынка становится ниже.

Представим, что вы открыли LONG по BTC и SHORT по ETH.

В режиме изолированной маржи, если ETH резко вырастет, ваш шорт может ликвидироваться, даже если BTC приносит прибыль.

В режиме Кросс-маржи прибыль по BTC автоматически поддерживает ваш SHORT по ETH — давая вам больше времени и пространства для реакции.

Это и есть настоящая эффективность капитала в действии.

Flipster разрабатывали так, чтобы ваш депозит всегда приносит пассивную прибыль.

Даже когда средства зарезервированы под единую кросс-маржу или иначе участвуют в сделках, они продолжают приносить доход по промо-акциям и приносить другие бонусы от Flipster.

Каждый доллар в кросс-марже — активный элемент общей доходности по депозиту.

Идеальное сочетание скорости торговли, высокой ликвидности и эффективности ваших активов.

Следите за общей нагрузкой:

единая маржа — это и единый риск; большая убыточная позиция может повлиять на все активные сделки.

Диверсифицируйте маржу:

сочетайте BTC, ETH и стейблкоины, чтобы выдерживать волатильность рынка дольше.

Используйте стоп-ордера:

даже в режиме кросс-маржи нужно соблюдать дисциплину и не забывать рассчитывать риск/прибыль.

Контролируйте соотношение маржи

(англ. Margin Ratio): следите за уровнями ликвидации, особенно перед решением увеличить размер той или иной позиции.

Этот материал предназначен исключительно для информационных целей и не является финансовой рекомендацией. Flipster не даёт никаких советов, гарантий или рекомендаций в отношении каких-либо цифровых активов, продуктов или услуг. Торговля цифровыми активами и их деривативами связана с высоким уровнем риска из-за сильной волатильности цен и может быть неподходящей для всех инвесторов. Пожалуйста, ознакомьтесь с нашими Условиями использования.

Flipster Crypto Weekly (October 10)

Следующая статьяИтоги крипто-недели (24 Октября)