A Complete Guide to Copy Trading Performance Indicators on Flipster

Understanding performance indicators is essential for anyone using Flipster Copy Trading — whether you’re evaluating Master Traders or reviewing your own copied portfolio. These metrics explain how efficiently a strategy performs, how much risk it carries, and how consistently it delivers returns over time.

Flipster calculates all metrics using standardized methods based on Total P&L (Realized + Unrealized, after fees) and ROI (Peak Capital method). This ensures fair, transparent comparisons across every Master Trader on the platform.

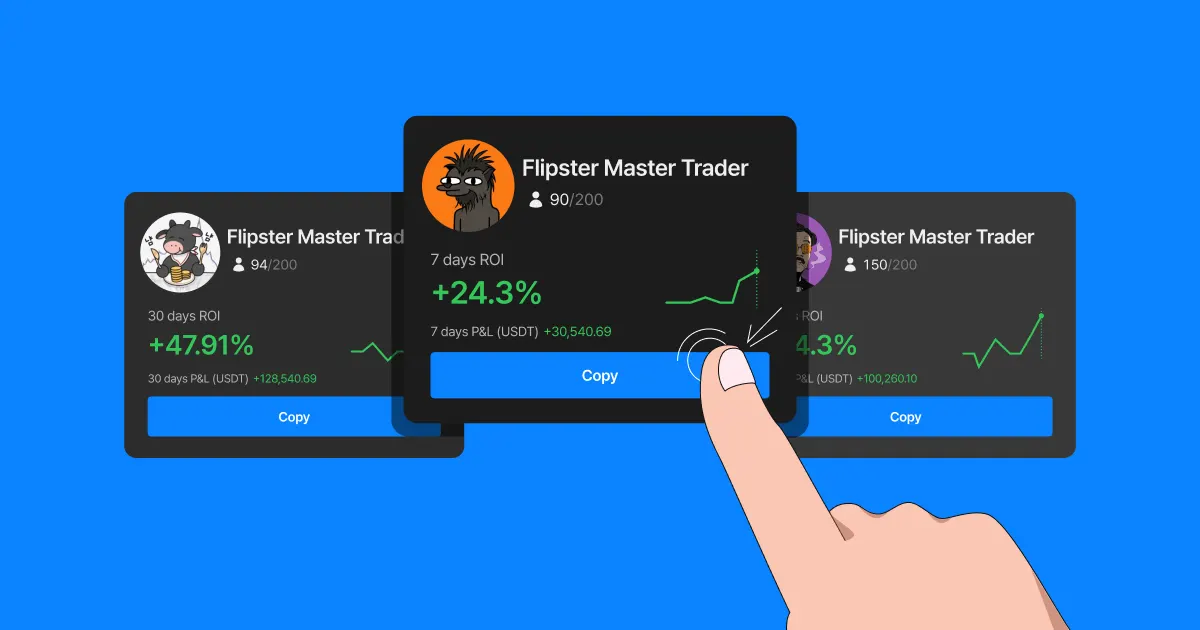

Performance data updates periodically and appears across various Copy Trading pages, including Portfolio Details and Master Overviews, allowing users to easily compare multiple strategies and choose one that fits their risk tolerance and investment goals.

All indicators are shown in USDT, and most update roughly every ten minutes depending on system load and data type.

Overview of Copy Trading Metrics

Every metric is calculated in USDT and designed to give new traders a clear understanding of both risk and return.

Below is a summary of what each metric means.

Performance Indicator Summary

Indicator | Description |

ROI (Return on Investment) | Shows how efficiently a Master Trader grows their portfolio relative to the highest invested capital (“Peak Capital”). |

P&L (Profit and Loss) | Total profit or loss from all positions, including both realized and unrealized values, after all fees. |

Sharpe Ratio | Measures risk-adjusted performance. Higher values indicate more stable gains relative to volatility. |

Maximum Drawdown (MDD) | The largest percentage drop in ROI from its peak, highlighting downside risk. |

Win Rate | The percentage of profitable closed positions out of all fully closed positions. |

Trading Volume | Total traded volume across all USDT perpetual pairs. |

Turnover Rate | Measures trading activity by comparing total volume to average assets. |

AUM (Assets Under Management) | Total combined margin balance of a Master Trader and all copiers following the portfolio. |

P&L

P&L reflects the true profitability of a Master Trader’s portfolio and includes both open and closed positions. All fees including trading fees and funding fees are already deducted.

P&L Formula

Total P&L = (Current Margin Balance – Initial Margin Balance) – Accumulated Deposits + Accumulated Withdrawals

Components Explained

Current Margin Balance: Current total funds including Unrealized P&L

Initial Margin Balance: Balance when the portfolio was first created

Accumulated Deposits / Withdrawals: Total fund movements since creation

Fees: All applicable fees (trading, funding, and insurance clear) are deducted automatically

Notes

Includes both Realized and Unrealized P&L for accurate reflection of portfolio status.

Total P&L serves as the base for ROI and profit share calculation.

All values are denominated in USDT and refreshed every 10 minutes.

Example

Item | Value (USDT) |

Initial Margin Balance | 1,000 |

Current Margin Balance | 1,400 |

Accumulated Deposits | 600 |

Withdrawals | 0 |

Total P&L | (1,400 – 1,000) – 600 = –200 USDT |

ROI

ROI measures the portfolio’s profitability of a Master Trader’s portfolio, relative to Peak Capital, which accounts for all deposits and withdrawals in a way that prevents performance distortion.

ROI Formula

ROI = (Total P&L / Peak Capital) × 100%

What Is Peak Capital?

Peak Capital represents the highest total capital that has ever been present in the portfolio, including the initial deposit plus all net deposits (deposits minus withdrawals). This method prevents ROI distortion that could occur from fund movements (deposits and withdrawals).

Peak Capital = Max (Initial Deposit + Net Deposits)

Key Details

ROI is updated whenever deposits or withdrawals occur.

A new Peak Capital is recorded each time a higher capital amount is reached.

ROI is calculated in USDT after fees.

The ROI shown in the portfolio is cumulative and updated every 10 minutes.

Example

Day | Margin Balance | Deposit | Withdrawal | Total P&L | Peak Capital | ROI (%) |

1 | 1,000 | – | – | 0 | 1,000 | 0% |

7 | 1,400 | +600 | – | +400 | 1,600 | 25.0% |

9 | 1,300 | – | – | +300 | 1,600 | 18.8% |

10 | 1,100 | – | –200 | +100 | 1,600 | 6.3% |

12 | 1,700 | +400 | – | +600 | 1,700 | 35.3% |

Sharpe Ratio

The Sharpe Ratio evaluates risk-adjusted returns, which is how much return a Master Trader generates relative to portfolio volatility.

Sharpe Ratio Formula

Sharpe Ratio = (Mean Daily Return × 365) / (Standard Deviation of Daily Return × √365)

Key Details

Calculated from daily ROI data.

The Sharpe Ratio is calculated using the full available trading history (maximum period) and shown as a single annualized value, regardless of the period selected in the interface.

Requires at least 30 days of valid data to be displayed.

Updated every 10 minutes.

How to Interpret It

Sharpe Ratio | Meaning |

> 3.0 | Excellent risk-adjusted returns |

2.0–3.0 | Very good |

1.0–2.0 | Moderate |

< 1.0 | Risky or unstable |

Maximum Drawdown (MDD)

MDD measures the largest drop in ROI from a peak to a subsequent low. It shows how much a trader’s portfolio can decline during volatility.

MDD Formula

MDD = MAX (Peak ROI – Lowest ROI After Peak)

Example

Day | ROI | Peak ROI | Drawdown (%) |

1 | 10% | 10% | – |

2 | 15% | 15% | – |

3 | 8% | 15% | 7% |

4 | 5% | 15% | 10% ← MDD |

5 | 12% | 15% | 3% |

Key Details

Calculated using interval cumulative ROI.

Shows the maximum percentage loss experienced before recovery.

A lower MDD generally indicates better capital preservation and more stable trading performance.

Generally, MDD below 20% is considered low risk, 20–40% moderate, and above 40% high risk, but this may vary by trading style and leverage level.

Win Rate

Win Rate is the percentage of closed positions that were profitable.

Formula

Win Rate = (Profitable Closed Positions / Total Closed Positions) × 100 %

Key Details

Only fully closed positions are counted. A position is counted as closed only when it is fully exited.

Partial closes do not count as separate positions.

Other Key Metrics: AUM, Trading Volume & Turnover Rate

Metric | Definition |

AUM (Assets Under Management) | Total margin held by a Master Trader plus all copiers. |

Trading Volume | Combined notional volume traded across all USDT perpetual pairs. |

Turnover Rate | Trading Volume ÷ Average Asset Balance, showing how actively the trader operates. |

How to Evaluate Master Traders More Effectively

Selecting the right Master Trader is not about chasing the highest ROI. Instead, look at a combination of factors that reflect both performance and risk.

1. Check for consistency

Compare short-term (1W), mid-term (1M), and long-term (3M+) results.

2. Prioritize risk-adjusted returns

A high ROI means little if paired with a high MDD or low Sharpe Ratio.

3. Understand trading behavior

Turnover Rate and position size patterns give insight into aggressiveness and leverage tendencies.

4. Confirm the depth of trading history

More history = more reliable data = more predictable performance.

Disclaimer: This material is for information purposes only and does not constitute financial advice. Flipster makes no recommendations or guarantees in respect of any digital asset, product, or service. Trading digital assets and digital asset derivatives comes with a significant risk of loss due to its high price volatility, and is not suitable for all investors. Please refer to our Terms.