Related Articles

Volatility is opportunity, but it’s also risk. Traders need flexibility to stay in the market when price swings are sharp. That’s where Cross Margin comes in: it extends the lifespan of your trades by pooling margin across all positions, so your capital adapts as markets move.

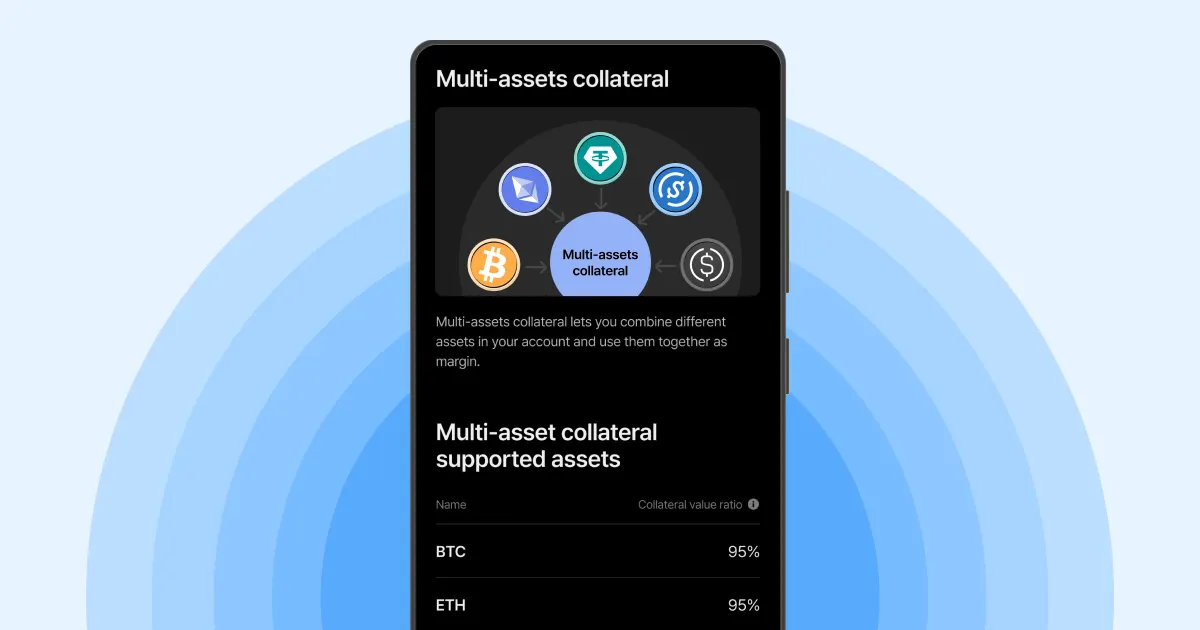

On Flipster, this means your BTC, ETH, USDT, USDC and digital dollars like USDe aren’t idle; they’re actively backing and balancing your portfolio.

When you enable Cross Margin mode, Flipster automatically combines your eligible assets (BTC, ETH, USDT, USDC, USDe) into one shared collateral balance.

Your margin pool then dynamically adjusts as positions fluctuate:

Unrealized profits can offset temporary losses

Liquidation thresholds adjust in real time

Collateral remains eligible for Flipster’s promotional reward programs

Every position benefits from shared liquidity, which translates to better survival during volatile market conditions.

Let’s say you’re long BTC and short ETH. In an Isolated Margin setup, if ETH rallies, your short might get liquidated even though your BTC long is in profit.

With Cross Margin, those BTC profits automatically support your ETH short, giving you more breathing room and time to adjust. That’s capital efficiency in action.

Flipster’s design keeps your balance productive. Whether your funds are sitting in margin or backing open trades, they continue to earn through promotional reward programs.

Every dollar of collateral, active or idle, contributes to your overall performance. It’s a seamless experience that blends trading speed, liquidity, and capital efficiency.

Monitor exposure: Shared margin means shared risk; one large loss can affect all positions.

Diversify collateral: Combine BTC, ETH, and stable assets for smoother volatility management.

Use stop orders: Even in Cross Margin mode, disciplined risk management protects capital.

Track your margin ratio: Keep an eye on liquidation thresholds as you scale trades.

Disclaimer: This material is for information purposes only and does not constitute financial advice. Flipster makes no recommendations or guarantees in respect of any digital asset, product, or service. Trading digital assets and digital asset derivatives comes with a significant risk of loss due to its high price volatility, and is not suitable for all investors. Please refer to our Terms.