Related Articles

When trading or investing in cryptocurrency, timing your entries can be just as important as the assets you choose. Two of the most widely used capital deployment strategies are Dollar-Cost Averaging (DCA) and lump-sum investing. While both can be profitable, the right choice depends on your market outlook, risk tolerance, and trading style.

In this guide, we’ll break down what DCA and lump-sum mean in the context of crypto trading, explore the pros and cons of each, and help you determine which approach works best for your goals.

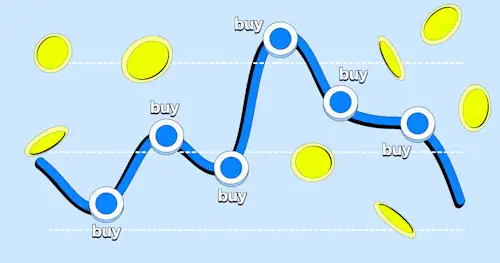

Dollar-Cost Averaging is a strategy where you invest a fixed amount of capital at regular intervals, regardless of the asset’s price. Instead of trying to time the perfect entry, you steadily accumulate a position over time.

You plan to invest $1,000 in Bitcoin. With DCA, you might buy $100 worth every week for 10 weeks, spreading your entry price over different market conditions.

Reduces Timing Risk: You’re less vulnerable to buying right before a price dip.

Smooths Out Volatility: Averages your cost basis in a volatile market.

Promotes Discipline: Encourages a rules-based approach, avoiding impulsive decisions.

Potentially Lower Returns in Bull Markets: Gradual buying can miss out on larger gains if prices rise quickly.

More Transaction Costs: Multiple buys mean more fees, especially on high-fee platforms.

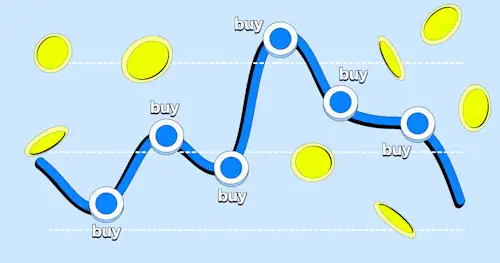

Lump-sum investing means committing your entire planned capital into a position at once. In crypto trading, this is often used when a trader believes a strong move is imminent.

You have $1,000 to invest in Ethereum and buy it all in a single transaction, securing one entry price.

Immediate Exposure: Best when you’re confident about a strong price move.

Lower Trading Fees: One transaction vs. multiple smaller buys.

Maximized Gains in Uptrends: If you time it right, you capture the full upside.

Higher Risk if Mistimed: A sudden drop can result in an immediate loss.

More Emotional Pressure: A single large entry increases the psychological stakes.

Your choice should be based on market conditions, risk appetite, and trading objectives:

Market Condition | Best Approach | Why |

High volatility/uncertain trend | DCA | Reduces timing risk and smooths entries |

Strong bullish trend | Lump-Sum | Maximizes exposure to upward momentum |

Range-bound/sideways market | DCA | Builds position before a breakout |

Short-term event or news catalyst | Lump-Sum | Captures immediate moves |

Regardless of which approach you choose, effective risk management is essential in crypto trading. Setting stop-loss orders can help protect your capital against sharp price reversals, ensuring that a single market swing doesn’t cause significant losses. It’s also important to avoid overexposure by risking only a small percentage—typically 1–2%—of your total capital on any given trade.

Additionally, always consider market liquidity before entering large positions, as trading low-liquidity assets can lead to slippage and unfavorable fills.

Finally, make it a habit to review your performance by keeping a detailed trading journal, allowing you to track results, identify patterns, and refine your strategy over time.

Psychological factors are just as important as technical skills when choosing a trading strategy. Dollar-Cost Averaging (DCA) is well-suited for traders who prefer to minimize emotional decision-making and maintain a consistent, rule-based approach over time. In contrast, a lump-sum strategy is better for those who are comfortable with short-term volatility and have confidence in their ability to time the market effectively.

There’s no universal winner in the DCA vs. lump-sum debate—it’s about matching the strategy to your market outlook and risk profile. DCA offers consistency and reduced timing risk, while lump-sum can deliver higher returns when your market call is correct. Many crypto traders even combine both, using DCA for long-term accumulation and lump-sum entries for short-term trading opportunities.

If you decide that DCA is the right strategy for your crypto journey, Flipster’s Recurring Buy feature lets you automate purchases of your favorite cryptocurrencies at fixed intervals—daily, weekly, or monthly. This hands-off approach removes the stress of timing the market while helping you steadily build your portfolio over time. Prefer a lump-sum approach for decisive market moves? Flipster has you covered there too. Enjoy tight spreads on listed pairs including BTC and ETH, ultra-low fees, and the ability to earn while trading.

Start trading on Flipster today and put your strategy—DCA or lump-sum—into action.

Disclaimer: This material is for information purposes only and does not constitute financial advice. Flipster makes no recommendations or guarantees in respect of any digital asset, product, or service. Trading digital assets and digital asset derivatives comes with a significant risk of loss due to its high price volatility, and is not suitable for all investors. Please refer to our Terms.

Flipster Crypto Weekly (August 1)

Next ArticleHow Flipster Stacks Up: Real Trading Costs Across Top Perps Exchanges