Related Articles

Ignight USDT Prime is a DeFi-based vault product that generates USDT yield through on-chain strategies. While investment outcomes depend on market conditions, performance is shaped by how risks are identified, monitored, and managed over time. This article outlines the key risks relevant to Ignight USDT Prime and explains the frameworks used to manage them, so users can better understand how capital is deployed across different environments.

In DeFi, headline yields often draw attention first. Over time, however, outcomes tend to reflect how risk is managed just as much as where yield is sourced.

Ignight USDT Prime is a DeFi‑based vault designed to generate yield through a diversified set of on‑chain strategies. Like all DeFi products, it operates within markets that can be volatile and complex. The goal of this framework is to manage risk deliberately so capital can remain productive across changing conditions.

Ignight USDT Prime is primarily exposed to four categories of risk:

Smart Contract Risk

Operational Risk

Market Risk

Liquidity Risk

These risks fall into two broad groups.

Infrastructure and execution risks, such as Smart Contract Risk and Operational Risk, relate to the systems and environments in which strategies are executed.

Investment strategy risks, such as Market Risk and Liquidity Risk, arise from how capital is allocated across DeFi strategies and how those exposures evolve over time. These risks account for most performance variation.

Other DeFi‑related risks exist, but this article focuses on those most likely to influence portfolio performance in a material way.

Risk

Ignight USDT Prime relies on smart contracts deployed on public blockchains. Vulnerabilities in code, protocol design, or oracle mechanisms may result in unintended outcomes, including potential loss of funds.

How It's Managed

Strategy deployment is limited to protocols with established usage history and market adoption. Smart contracts are evaluated based on independent third-party audits, with preference given to protocols that have operated on mainnet over extended periods and undergone multiple audit reviews. This approach reduces exposure to untested or experimental code paths.

Risk

On-chain asset management requires secure custody and disciplined execution. Failures in authorization, security breaches or operational errors may disrupt fund operations or result in asset loss.

How It's Managed

Ignight USDT Prime uses Fireblocks’ MPC-based custody infrastructure, with multi-party approvals required for asset movements. All strategies operate under a 100% on-chain mandate, allowing users to independently verify how assets are deployed and managed at any time.

Risk

Crypto markets can experience rapid price and rate changes. These movements may affect collateral values, borrowing costs, and strategy performance, particularly during periods of market stress.

How It's Managed

Capital is diversified across assets and strategies to reduce concentration risk. Where leverage is used, it is applied conservatively. Collateral selection prioritizes assets with deep liquidity and established market credibility, supporting more resilient performance during volatile conditions.

Risk

Liquidity conditions in DeFi markets may tighten during stress events. Large or simultaneous withdrawals can require positions to be unwound under less favorable conditions.

How It's Managed

The portfolio is structured to maintain liquidity across multiple strategies, with a portion of capital allocated to positions that support timely exits. Liquidity conditions are monitored continuously. A standard redemption window of up to 48 hours is applied to allow assets to be unwound in an orderly manner, reducing the likelihood of forced liquidations or value leakage.

During periods of elevated withdrawal demand, temporary extensions may be used to protect portfolio integrity and minimize slippage for all users.

While infrastructure risks are addressed through protocol selection and operational controls, Market Risk and Liquidity Risk are primarily managed through portfolio construction and allocation discipline.

Ignight USDT Prime is designed to balance yield generation with the practical realities of liquidity, scalability, and capital preservation.

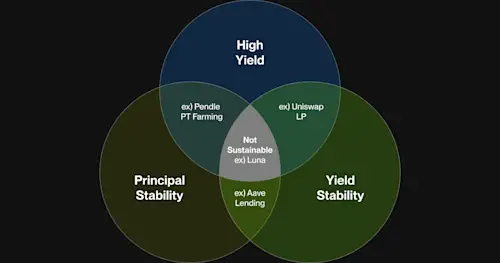

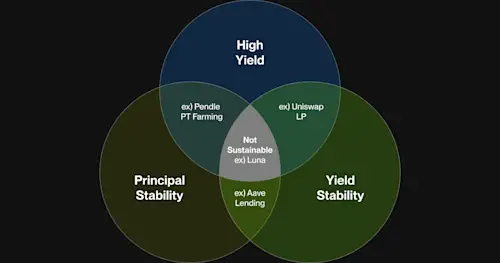

Market risk differ by strategy. Ignight USDT Prime manages this through diversification, sizing, and explicit limits across the following categories:

Lending strategies generate yield by depositing stable assets into on-chain money markets, where other users deposit collateral to borrow those assets and pay interest.

Lending strategies are exposed primarily to interest rate volatility and bad debt risk, particularly during periods of market stress. Sharp declines in collateral values or sudden shifts in capital flows can lead to rapid changes in borrowing rates, liquidation activity, or protocol health.

Risk is managed through diversification across protocols and chains, predominatly unlevered positions, and active allocation adjustments when market conditions or protocol risk indicators change beyond predefined thresholds.

Pendle PT strategies generate yield by purchasing Principal Tokens (PTs), which represent the right to receive a fixed amount of an underlying yield-bearing asset at maturity. Yield is realized by acquiring PTs at a discount and holding them to maturity, with the difference between purchase price and redemption value representing the fixed return.

While PTs provide fixed-rate exposure when held to maturity, their market prices fluctuate based on implied rates, time to maturity, and secondary market liquidity. As a result, PT risk characteristics can vary by underlying asset, maturity, and market depth.

Market risk is managed through diversification across maturities and chains, explicit position size limits per PT market, and predefined exit or de-risking actions when implied rates move sharply or market depth deteriorates.

Delta-neutral basis strategies aim to generate yield by capturing spreads between funding rates, incentives, or yield components while minimizing direct exposure to asset price direction. These strategies rely on hedging mechanisms to offset market beta and focus on relative value rather than directional returns.

Delta neutral strategies are exposed to funding rate changes, execution risk, and extreme market dislocations.

Market risk is managed through conservative sizing, diversification across venues where applicable, and active monitoring of funding dynamics and hedge effectiveness during periods of stress.

Looping strategies generate yield by recursively borrowing against collateral to increase exposure to a yield-bearing position. Returns are amplified through leverage, but so are sensitivities to changes in borrowing costs, collateral values, and liquidity conditions.

Because leverage magnifies both gains and losses, looping strategies introduce higher market risk than unlevered positions.

Market risk is managed by maintaining conservative loan-to-value targets, enforcing explicit leverage caps, and applying predefined deleveraging or unwind rules when borrowing costs rise, collateral values decline, or liquidity conditions weaken.

To support predictable withdrawals and portfolio flexibility, strategies are organized into tiers with different liquidity characteristics.

Large pools

Large, highly liquid strategies form the portfolio’s core liquidity layer, prioritizing depth, scalability, and predictable exits. Examples include large overcollaterallized lending pools and Pendle PT pools with deep secondary liquidity.

Mid-sized pools

Mid-sized strategies are used selectively to enhance yield within clearly defined capacity and liquidity limits. These strategies typically include mid-sized fixed-rate Pendle PT pools and structured products with defined caps and moderate liquidity depth.

Smaller pools

Smaller or incentive-driven opportunities are accessed opportunistically with strict sizing constraints.

Across all tiers, allocation decisions prioritize the ability to rebalance and meet withdrawals under stressed conditions.

Risk controls are applied continuously to ensure alignment with portfolio objectives:

Allocation ranges and exposure limits are defined in advance

Rebalancing responds to changes in yields, incentives, and risk signals

Governance updates, risk disclosures, and security events are continuously monitored across protocols

These controls are intended to preserve flexibility and prevent unintended risk accumulation over time.

Ignight USDT Prime is built for users who want on-chain yield exposure with a structured approach to risk. While no DeFi product can remove risk entirely, this framework is designed to keep risk observable, managed, and proportionate as market conditions evolve.

As with any DeFi allocation, users should consider their own risk tolerance. Ignight USDT Prime aims to provide a clear, disciplined foundation for deploying USDT in on-chain markets, with risk management treated as an ongoing process rather than a static checklist.

Disclaimer: Ignight USDT Prime is not a Flipster product. Flipster’s role is that of a technical intermediary to enable users to access Ignight USDT Prime which is being offered by an independent third party provider. Flipster does not provide any investment, financial, legal or other advice in relation to Ignight USDT Prime.

Flipster Crypto Weekly (January 2)

Next ArticleThe Survivor Strategist: Inside AlexnguyenTCX’s DCA-Driven Trading Framework