Related Articles

Order books are easy to recognize, with their rows of red and green numbers and prices ticking up and down. But what you’re looking at is far more than noise on a screen. It’s an important part of any trading platform.

So, what is an order book, and why do experienced traders obsess over it? A crypto order book is a real-time window into the market’s brain. It shows you who’s buying, and who’s selling, at what price. Learning how to read order books is valuable.

The more you learn, the more effectively you can tap into actual patterns of trader behavior and the factors that shape the price of every coin on the screen. Binance, for example, handles more than 1.4 million orders per second on its Binance order book, helping drive its $76 billion in daily trading volume.

Whether you're curious about order book crypto mechanics or want to learn how to read an order book, this guide covers it all.

Crypto order books are constantly updated lists of buy and sell orders for a specific asset, such as Bitcoin, ETH, or DOGE. It’s where all trading happens. You’re not just buying from “the market”; you’re buying from someone else’s offer sitting in that book, waiting to be matched.

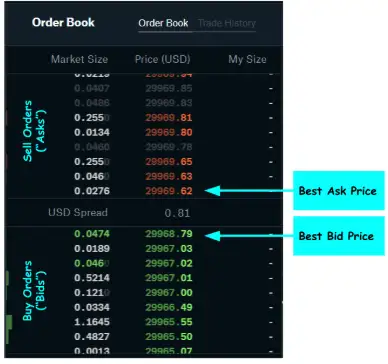

These orders are sorted into two sides:

Bids (green): Buy orders, ranked from highest to lowest price.

Asks (red): Sell orders, from lowest to highest price.

The order book crypto traders use on platforms like Coinbase or Kraken shows the balance of power between these two. If bids outweigh asks, the price tends to climb. If sellers dominate, the price drops.

The order book trading screen reveals intent, pressure, hesitation, and all of it plays out live. It’s like having a live map of demand and supply, helping determine prices based on who’s willing to buy or sell at what level.

Unlike traditional stock exchanges, crypto’s order books are always live, always updating, offering a raw, unfiltered view of the market.

Every order book might look slightly different depending on the platform, but the structure is nearly universal with the same core components.

These are buy orders waiting to be filled. Each row shows:

Price: What the buyer is willing to pay.

Size: How much do these buyers want to buy at that price.

The highest bid is at the top, because that’s the best offer buyers are currently making. Think of it as an auction, except everyone can see everyone else’s hand.

These are sell orders and they show:

Price: What the seller wants to get.

Size: How much these sellers are offering at that price.

The lowest ask goes at the top. That’s the best available deal for buyers right now. The spread, the gap between the best bid and ask, is often where a lot of price action happens.

Each price level in the order book is accompanied by a volume figure, indicating the size of open orders at that specific price. For example, a significant concentration of ETH sell orders at $3,200 may act as a resistance level, potentially slowing or halting upward price movement.

The number of visible price levels beyond the top bid and ask reflects the market’s depth—commonly referred to as order book depth. This depth serves as a key measure of liquidity and market resilience. A deep order book allows for larger trades with minimal price disruption, while a shallow book often signals reduced liquidity and increased susceptibility to volatility.

In the world of crypto trading, the order book functions much like a heartbeat monitor—constantly updating and reflecting market activity in real time. Every time a trader places a new market order or adjusts a limit order, the order book responds instantly. Far from being a static display, it serves as a live, dynamic interface that captures the continuous interaction between buyers and sellers.

Here’s how the process unfolds: Suppose a trader submits a market buy order for 2 BTC. The system will first match that order with the lowest ask price available—say, $68,500. If only 1 BTC is available at that price, the remaining order will automatically be matched with the next best ask, perhaps at $68,550. This rapid process of matching orders across price levels is known as order matching and occurs within milliseconds.

As trades are executed, matched orders are removed from the book, while new limit orders are inserted at appropriate levels. Others may be modified or canceled altogether. This continuous reshuffling, often referred to as the order book engine, is managed by the exchange.

While price often grabs the spotlight, liquidity is a critical—and often underestimated—driver of trading performance. The order book is where this liquidity comes to life, offering a real-time snapshot of market depth.

Market depth refers to the volume of open buy and sell orders distributed across various price levels. A deeper order book indicates a more liquid and stable market—one in which large trades can be executed without significantly impacting price. For instance, selling 500 ETH in a deep market might be absorbed across several bid levels with minimal price movement. In contrast, in a shallow market, the same order could cause a sharp drop in price.

Market depth is typically visualized through a depth chart, where green represents buy orders (bids) and red represents sell orders (asks). These “walls” of liquidity often form psychological support and resistance zones, guiding trader behavior.

High liquidity minimizes slippage and keeps bid/ask spreads tight, which is why experienced traders pay close attention not just to price, but to the underlying volume and order flow behind it.

Behind every number in the order book is a strategy. Traders don’t all use the same order types, and each type behaves differently inside the order book crypto environment. Common options include:

Market orders are considered aggressive trades. When placing a market order, you are instructing the exchange to execute the trade immediately at the best available price—regardless of the cost. The system automatically matches your order with the most favorable opposing order in the book to ensure prompt execution.

Fast execution

Zero price control

High slippage risk in low-liquidity markets

A limit order specifies the exact price at which you are willing to buy or sell an asset. It remains in the order book until it is either executed at the designated price or manually canceled.

Precise control

No slippage

May not fill if the market never reaches your price

This is how many traders position themselves ahead of the action.

Stop orders are conditional orders that become active only when a predetermined price level is reached. Commonly used for stop-losses or entry points, they automatically convert into market or limit orders once triggered.

Useful for automating exits

Not visible in the order book until triggered

Helps manage risk

Understanding how to read an order book goes beyond simply observing buy and sell activity—it’s about interpreting trader behavior and market sentiment. When used effectively, the crypto order book becomes a valuable analytical tool, helping traders detect momentum changes, anticipate potential reversals, and refine the timing of their entries and exits.

Here are a few key strategies for leveraging the order book:

Significant clusters of buy or sell orders—commonly known as "order walls"—can act as psychological support or resistance levels. A large buy wall may signal strong support, while a prominent sell wall can indicate overhead resistance. However, be cautious, as some walls may be strategically placed to mislead other market participants.

The spread, or the gap between the highest bid and lowest ask, reflects the market’s liquidity. A tight spread typically suggests a liquid and competitive market, whereas a wide spread indicates thinner liquidity and a higher risk of slippage.

Empty areas between price levels—known as liquidity gaps—can lead to sharp price movements if a large order is executed. These gaps represent vulnerable points in the market structure.

Sudden influxes of buy or sell orders, repeated cancel-and-replace activity, or rapid stacking on one side of the book can signal shifting momentum. Recognizing these patterns early can provide a tactical edge in anticipating short-term market direction.

While order books offer valuable real-time insight into market sentiment, not every order displayed is placed with honest intent. In crypto markets—particularly on lightly regulated exchanges—some traders exploit order books to mislead others, a practice known as order book manipulation.

Though illegal in traditional markets like the NASDAQ, these tactics remain a concern in crypto. Two of the most common forms include:

Spoofing: A trader places a large buy or sell order with no intention of executing it, creating a false signal of demand or supply. For example, a massive buy order at $64,000 may appear to suggest bullish momentum. Other traders react by entering long positions, only for the spoofed order to be canceled just before execution—allowing the manipulator to sell into the price spike. This tactic is banned in traditional finance and has been the subject of enforcement actions by regulators like the SEC, though oversight in crypto remains limited.

Layering: Layering involves placing a series of deceptive orders at multiple price levels to fabricate a sense of market depth. This technique falsely reinforces a trend, misleading other traders about the strength of price support or resistance.

How to Spot Manipulation:

1. Watch for large orders that frequently disappear before being filled.

2. Note repeated patterns around key support or resistance levels.

Recognizing these behaviors can help protect traders from falling prey to artificial signals and distorted market conditions.

While all order books operate on the same foundational concept, not all trading platforms deliver the same level of performance.

Look for these essential features:

Real-time updates with minimal latency

High liquidity to reduce spreads and mitigate slippage

A clean, intuitive interface that clearly displays market depth, volume, and price tiers

Support for advanced order types, such as stop-limit and trailing stop orders

For serious traders, understanding the order book is non-negotiable. It's more than just a ledger of buy and sell orders—it’s a real-time reflection of market intent. The ability to interpret these signals turns reactive trading into strategic decision-making.

Every trade interacts with the order book. It serves as the marketplace, the playbook, and the scoreboard all at once. The better you understand it, the more confidently and precisely you can trade.

An order book is a real-time record of buy and sell orders for a specific asset on a trading platform. It displays the prices and quantities that traders are willing to transact at, allowing users to view market depth and gauge supply and demand dynamics.

To interpret an order book, begin by identifying the highest bid price (buyers’ top offer) and the lowest ask price (sellers’ minimum). The difference between these two is known as the spread. Significant order volumes at particular price points may indicate potential support or resistance levels in the market.

A market order is executed immediately at the best available price, providing speed but potentially incurring slippage in volatile markets. In contrast, a limit order allows you to specify your desired price, offering greater control, but it will only be filled if the market reaches your set price.

Level 2 data provides insight beyond the best bid and ask—it displays multiple price levels and the corresponding volumes on both sides of the market. This deeper visibility helps traders analyze short-term trends and monitor the behavior of large market participants.

Price changes occur when orders are executed. For instance, aggressive buying that consumes available sell orders pushes the price upward, while persistent selling can cause it to decline. Observing order flow and volume imbalances in the order book can help traders anticipate directional shifts in the market.

Order book manipulation involves placing deceptive orders to mislead other traders—commonly seen in practices like spoofing or layering. These involve placing large orders with no intent to execute, then quickly removing them to influence price perception. Indicators of manipulation include large orders that repeatedly appear and disappear without being filled. Consistent, static orders are generally more reliable.

Disclaimer: This material is for information purposes only and does not constitute financial advice. Flipster makes no recommendations or guarantees in respect of any digital asset, product, or service. Trading digital assets and digital asset derivatives comes with a significant risk of loss due to its high price volatility, and is not suitable for all investors. Please refer to our Terms.

Flipster Crypto Weekly (June 6)

Next ArticleWill the Next Crypto Bull Run Start in 2025?