Related Articles

On-chain yield can be powerful. It can also be complex, fragmented, and difficult to manage.

Dynamic Earn is Flipster’s on-chain earn hub, designed to make DeFi yield more accessible without requiring users to manage wallets, bridge assets, or actively monitor strategies. It brings strategic management of on-chain strategies directly into the Flipster platform, so capital can earn yield while remaining usable for trading.

Dynamic Earn combines three principles that matter in volatile markets: clarity, capital efficiency, and control.

Dynamic Earn is Flipster’s curated gateway to on-chain yield opportunities.

Instead of interacting directly with DeFi protocols, users access strategically managed strategies through a single Flipster interface. Strategy execution happens on-chain, while subscription, disclosures, and redemptions are handled within Flipster.

What this means in practice

No wallet setup or private key management

No bridging between chains

Subscribed assets can continue to support trading activity

Dynamic Earn is designed for users who want exposure to on-chain yield without taking on the operational complexity of DeFi directly.

Ignight USDT Prime is the first flagship product on Dynamic Earn.

It is a strategically managed USDT yield strategy that allocates capital across diversified on-chain opportunities, with allocations adjusted as market conditions change. The focus is on consistent yield, liquidity management, and capital efficiency.

Key details

Asset used for subscription:USDT

Estimated APR: ~11.7%*

Total capacity: 10M USDT

Manager: Ignight

Execution: Fully on-chain

*As at 9 Jan 2026, APR is based on a fixed 11.7% target APR during the initial phase, with performance fees included. As performance data accumulates, APR will transition to a 7-day historical APR measure, updated daily. Estimates may change with market conditions. Past performance does not guarantee future results.

Ignight Capital is a DeFi-focused investment firm that has been active since 2022, working with established on-chain infrastructure and protocols such as Gnosis Safe.

For Ignight USDT Prime, Ignight Capital acts as the strategy manager, responsible for:

Portfolio construction

Allocation and rebalancing decisions

On-chain strategy execution

All strategies operate under a 100% on-chain mandate, with no off-chain fund management permitted.

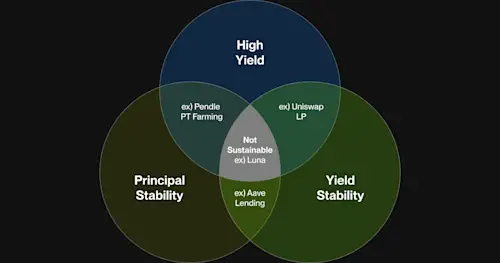

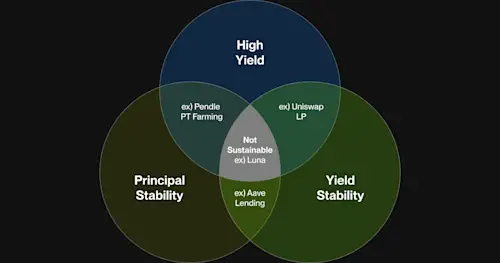

Ignight USDT Prime deploys capital across multiple on-chain yield sources rather than relying on a single protocol or strategy.

At a high level

Capital is allocated across lending markets, fixed-income-style products, and delta-neutral strategies

Moderate leverage may be used within predefined risk parameters

Strategies are actively monitored and rebalanced

No single protocol dominates portfolio exposure

All strategy execution occurs on-chain, while users interact entirely through Flipster.

The strategy is designed to pursue yield through diversified on-chain approaches, with ongoing rebalancing based on market conditions.

Automated allocation across multiple yield sources

Continuous monitoring and risk guardrails

Designed to reduce reliance on any single yield driver

This approach aims to smooth returns over time rather than maximize short-term yield.

Once subscribed, up to 85% of your Ignight USDT Prime assets remain usable as cross-margin collateral on Flipster.

This allows users to:

Maintain active trading positions

Hedge exposure when needed

Reallocate capital quickly

At the same time, the standard redemption fee is 0%, reducing friction when rotating or exiting positions.

This structure improves capital efficiency compared to products that fully lock funds during the earning period.

Ignight USDT Prime is executed fully on-chain, offering greater visibility into how capital is deployed.

Strategy activity is recorded on-chain

Allocation changes can be independently observed

Reduces reliance on opaque, black-box vault structures

Strategy execution follows predefined parameters and on-chain rulesets, with transparent deployment visible on-chain. This structure allows users to better understand how strategies operate without relying solely on off-chain reporting.

Many DeFi earn products rely on opaque structures where users have limited visibility into how funds are managed.

Dynamic Earn takes a different approach.

100% on-chain mandate: All assets and strategy activity are executed fully on-chain. No off-chain fund management or external capital transfers are permitted.

Visible execution: Allocation changes are reflected transparently, visible either in Flipster’s product dashboard

or directly on-chain, rather than hidden behind abstractions.

Centralized access point: Users subscribe, review disclosures, and manage positions through Flipster’s UI.

This structure aims to reduce common failure modes seen in past DeFi incidents, particularly around unclear fund movements and strategy opacity.

A key limitation of many earn products is forced choice: earning or trading.

Dynamic Earn is structured to avoid that trade-off.

With Ignight USDT Prime:

Subscribed assets can continue supporting trading activity

Capital remains flexible during market volatility

Users can respond quickly without fully unwinding earn positions

Ignight USDT Prime uses a straightforward fee model.

10% performance fee

Fee applies only to profits

No fee charged on principal

Some comparable vault-style products charge performance fees closer to 20%. Over time, lower fees can result in meaningfully higher net yield retained by users, assuming similar gross performance.

Standard redemption carries 0% fee, reducing friction for normal exits or reallocations. An instant redemption option is also available with a nominal fee (0.25%).

The redemption framework is designed to support orderly exits while managing underlying on-chain liquidity.

Learn more about Dynamic Earn here: https://flipster.io/dynamic-earn

Disclaimer: Ignight USDT Prime is not a Flipster product. Flipster’s role is that of a technical intermediary to enable users to access Ignight USDT Prime which is being offered by an independent third party provider, Iglux Tampesta Technologies, Inc. Flipster does not provide any investment, financial, legal or other advice in relation to Ignight USDT Prime.